Gregory Mannarino: THE BIGGEST MARKET MELTDOWN IN HISTORY IS COMING… Just Not Yet

TradersChoice.net, Released on 11/18/20

Gregory Mannarino

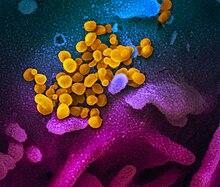

The 2020 stock market crash, also referred to as the Coronavirus Crash, was a major and sudden global stock market crash that began on 20 February 2020 and ended on 7 April.

The crash was the fastest fall in global stock markets in financial history and the most devastating crash since the Wall Street Crash of 1929. The crash, however, only caused a short-lived bear market, and in April global stock markets re-entered a bull market, which would continue until late October of that year

The Coronavirus Crash followed a decade of economic prosperity and sustained global growth after recovery from the GFC began in 2009. Global unemployment was at its lowest in history, whilst quality of life was generally improving across the world. In 2020 however, the COVID-19 pandemic, which is currently the most impactful pandemic since the flu pandemic of 1918, began - decimating the economy. Global economic shutdowns occurred due to the pandemic, panic buying and supply disruptions exacerbated the market, and mass hysteria ensued. The International Monetary Fund had pointed to other mitigating factors seen pre-COVID-19, such as a global synchronized slowdown in 2019, as exacerbants to the crash as the market was already vulnerable.

During 2019, the IMF reported that the world economy was going through a 'synchronized slowdown', which entered into its slowest pace since the financial crisis of 2007–08. 'Cracks' were showing in the consumer market as global markets began to suffer through a 'sharp deterioration' of manufacturing activity. Global growth was believed to have peaked in 2017, when the world's total industrial output began to start a sustained decline in early 2018. The IMF blamed 'heightened trade and geopolitical tensions' as the main reason for the slowdown, citing Brexit and the China – United States trade war as primary reasons for slowdown in 2019, while other economists blamed liquidity issues.

Since the financial crisis of 2007–08, there has been a large increase in corporate indebtedness, rising from 84% of gross world product in 2009 to 92% in 2019, or about US$72 trillion. In the world's eight largest economies–China, the United States, Japan, the United Kingdom, France, Spain, Italy, and Germany–total corporate debt was about $51 trillion in 2019, compared to $34 trillion in 2009. The Institute of International Finance forecast in 2019 that, in an economic downturn half as severe as the 2008 crisis, $19 trillion in debt would be owed by non-financial firms without the earnings to cover the interest payments on the debt they issued. The McKinsey Global Institute warned in 2018 that the greatest risks would be to emerging markets such as China, India, and Brazil, where 25-30% of bonds had been issued by high-risk companies

Comments

Post a Comment